Good deeds always get appreciated. Even government authorities showcase a sweet gesture of allowing tax benefits of making charities and donations. This is to encourage people for making donations but the details of the tax benefits are still unclear among the people. In this blog, we will explain the scenario in which the tax benefits are allowed, the US tax benefits 501(c)(3) and tax exemption in India under section 80G.

So, let’s take a ride.

Tax Benefits are applicable when

- Land or Property or Cash is donated: A declaration or notice of making a donation doesn’t get the tax benefits. The actual donation has to be done like transaction after which the amount donated will be considered for tax exemption.

- The Organization must be registered: Not all the organizations are registered as an entity whose donations will be exempted. So, if the donations are made to an unregistered NGO or charitable foundation, there won’t be any amount that can be levied for tax benefits.

- Proper paperwork mandatory: Each and every donation slip, legal or eligible document, material or immaterial transfer of property, funds, etc are compulsory backed by the proper paperwork by donors in order to claim for tax exemption.

US Tax Benefits under 501(c)(3)

Let’s understand the meaning of 501(c)(3) given on the official website 501c3.org as follows:

“Section 501(c)(3) is the portion of the US Internal Revenue Code that allows for federal tax exemption of nonprofit organizations, specifically those that are considered public charities, private foundations or private operating foundations. It is regulated and administered by the US Dept Treasury through the Internal Revenue Service”.

This tax benefit allows you to claim for the tax benefits for an individual is up to 1/3rd of the total income. The companies get tax benefits for all donations given to registered org, providing their claim does not exceed their total annual net income.

Tax Benefits under 80G India

All the donations are not eligible for tax benefits in India. Donations made to certain registered organizations and charitable relief funds are considered for tax benefits under 80G in India.

The website ‘Cleartax.in’ mentioned their article about 80G as

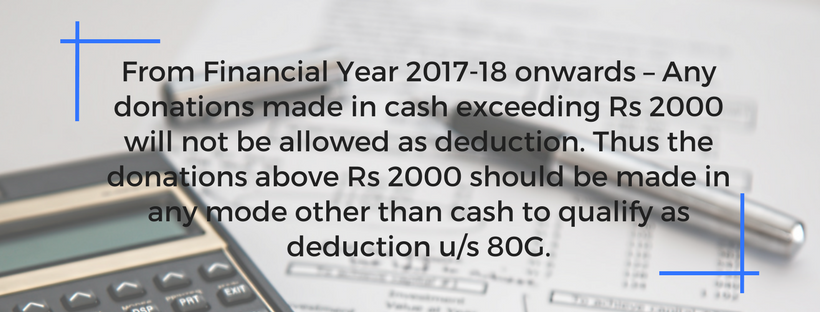

- Only cash, cheque or DD should be the mode of payment and cash donations should not be exceeding 10,000 rs.

- Donations made in form of gifts, clothes, food items are not included for tax benefits.

- The donor is eligible for 50% to 100% of tax deductions with additional clauses.

All the content in this blog is intended to provide the best knowledge based on the changes or latest updates as on 17th of Jan 2018, readers discretion required.

Seruds is a registered NGO and all the donations and charities are totally exempted under tax benefits. To know more about our legal status, click here.

Start making donations and charities to seruds and our partners